SAAC's Team

July 9, 2024

sing the NPER Function in Excel: A Guide

What is the NPER Function?

The NPER function in Excel is a financial tool that calculates the number of payment periods required to settle a loan or reach an investment goal. It’s particularly useful for:

- Loan Repayment: Determine how long it will take to pay off a mortgage, car loan, or student loan.

- Investment Planning: Figure out how many years it will take to reach a specific savings target.

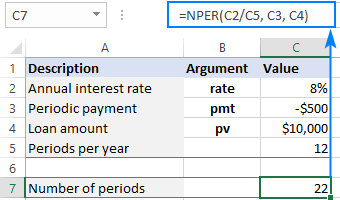

Understanding the NPER Function’s Arguments

The NPER function requires the following arguments:

- Rate (required): The interest rate per period. Ensure the rate matches the payment frequency (e.g., monthly rate for monthly payments).

- Pmt (required): The fixed payment made each period. This usually includes both principal and interest.

- Pv (required): The present value, or the current loan amount or initial investment.

- Fv (optional): The future value, or the desired balance after the final payment. If omitted, Excel assumes a future value of 0 (meaning the loan is fully paid off or the investment reaches its goal).

- Type (optional): Indicates when payments are due:

- 0 (or omitted) for payments at the end of each period

- 1 for payments at the beginning of each period

NPER Function Formula

The syntax for the NPER function is:

=NPER(rate, pmt, pv, [fv], [type])

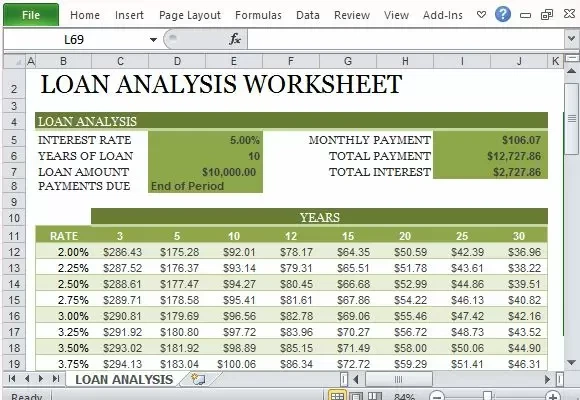

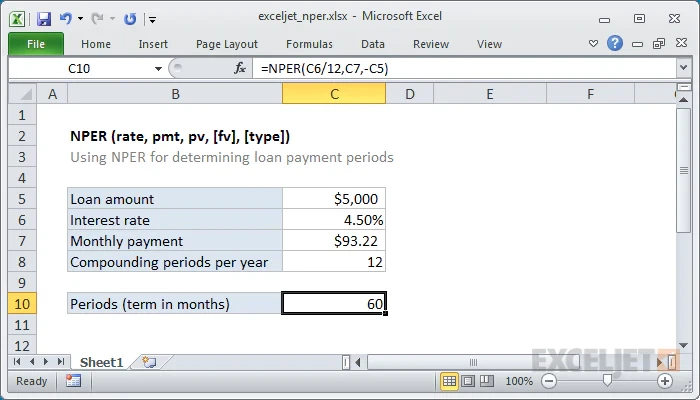

Example: Calculating Mortgage Repayment Periods

Let’s say you have a $300,000 mortgage with a 4% annual interest rate and monthly payments of $1,432.25. Here’s how to use the NPER function:

-

Set Up Your Data:

-

Enter the NPER Formula:

- In a cell, type:

=NPER(0.04/12, -1432.25, 300000) - Note: We divide the annual interest rate by 12 to get the monthly rate. The payment is negative because it’s an outgoing cash flow.

- In a cell, type:

-

Get the Result:

- Excel returns 360, meaning it will take 30 years (360 months) to pay off the mortgage.

Important Considerations

- Consistency: Ensure the interest rate and payment frequency match (e.g., both monthly).

- Negative Signs: Payments should be entered as negative values.

- Error Handling: If the NPER function returns #NUM!, it means the loan or investment cannot be repaid with the given parameters.

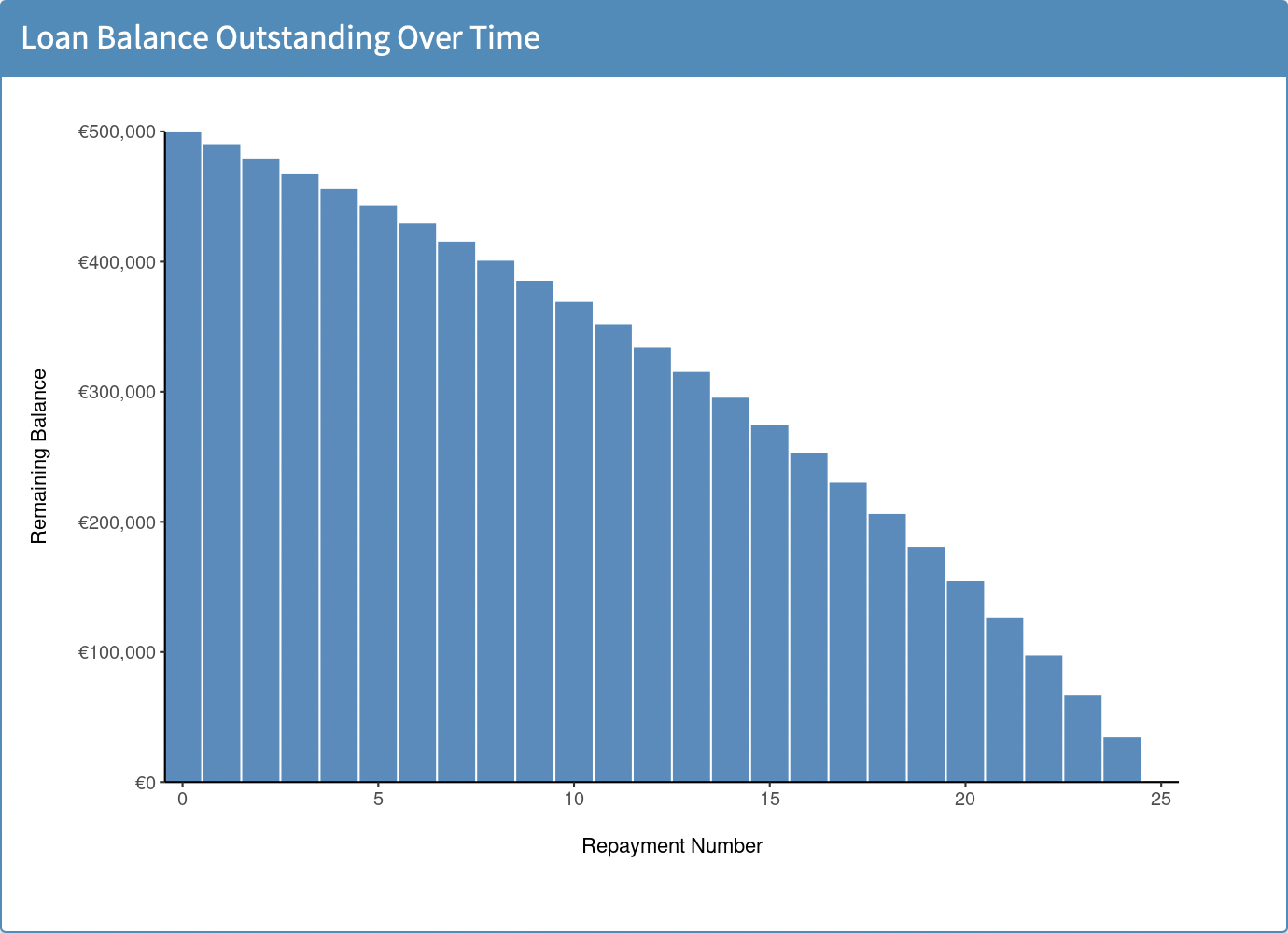

Visualizing the NPER Results

You can use Excel’s charting tools to create a visual representation of how your loan balance changes over time. This can be helpful for understanding the impact of different payment amounts or interest rates.

Key Takeaways

- The NPER function is a valuable tool for financial planning and analysis.

- By understanding its arguments and using it correctly, you can gain valuable insights into your loans and investments.

Subscribe

Login

0 Comments

Oldest